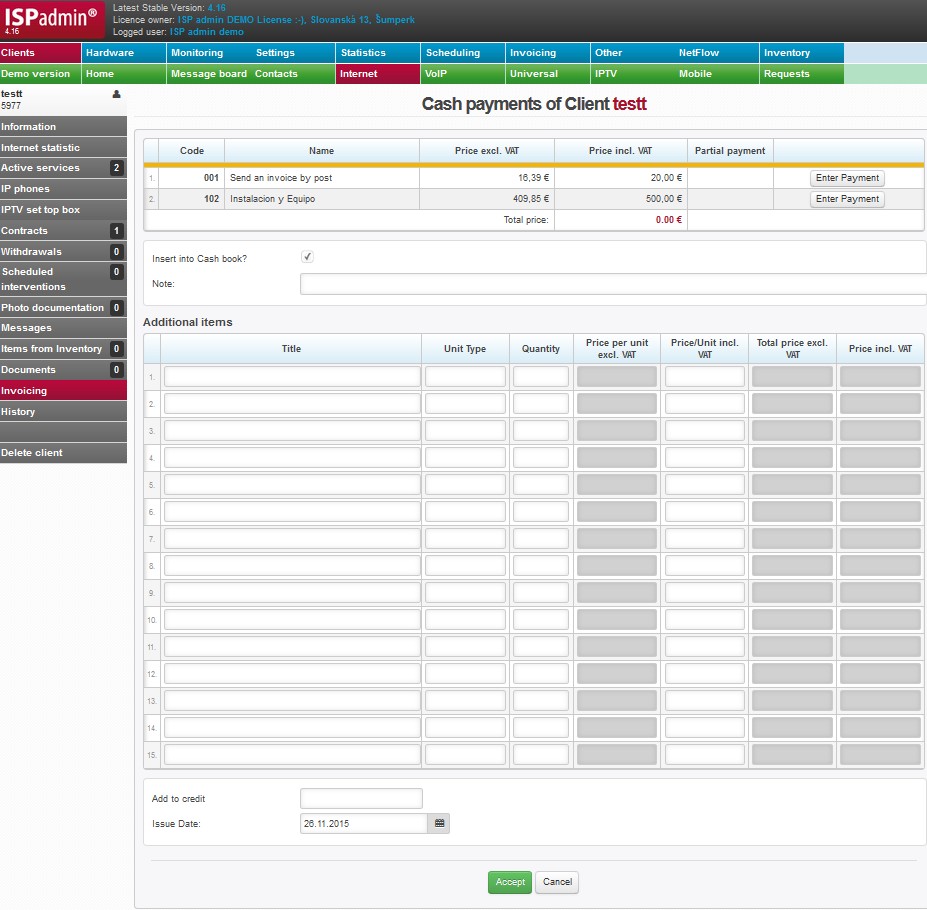

| Enter Payment | Click on each row for which client makes payment. If a row stands for invoice it can be paid partially by inserting different amoutn. |

| Insert into Cash book? | Selected Adding to Invoicing Cash Book |

| Note | Note on cash payment |

| Additional items | Cash payments may be followed by sale of some goods, e.g. client is in your shop and purchases UTP cable. |

| Cash Receipt Number | Cash receipts are numbered automatically, you will be able to modify cash receipt number only if ID hotovostni_doklad_rozdeleni = 1 (Invoicing Settings General). |

| Add to credit | If payment exceeds current debt exceeding amount is added to client credit, i.e. overpayments . |

| Issue date | Issue date of cash receipt. Current date is set by default, you can change it. |

Accept - payment is saved - Payment accepted ![]() Print Receipt

Print Receipt ![]() Show Receipt is displayed in the upper part of the screen.

Show Receipt is displayed in the upper part of the screen.

Select form of cash receipt in Invoicing Settings General, ID hotovostni_doklad. The receipt consists of 2 identical parts, one of which you keep for yourself and the other one you give to the customer. The options are:

| standard cash receipt | simple cash receipt |

Payment will not be listed in Client's Cash Payments.

VAT missing on a cash receipt

If the client pays for the invoice in cash, VAT tax is not stated on the cash receipt. VAT is not given for a simple reason - the tax is stated right on on the issued invoice. If VAT were stated also on the cash receipt, the client might enter it among their expenses and this would be incorrect.